Renters Insurance in and around Silver Spring

Renters of Silver Spring, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Silver Spring Renters!

The place you call home is the cornerstone for everything you treasure. It’s where you build a life with the ones you love. Home is truly where your heart is. That’s why, even if you live in a rented home or condo, you should have renters insurance—especially if you could not afford to replace lost or damaged possessions. It's coverage for the things you do own, like your stereo and running shoes... even your security blanket. You'll get that with renters insurance from State Farm. Agent Michael Palmiotto can roll out the welcome mat with the dedication and skill to help you protect yourself from the unexpected. Attentive care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Renters of Silver Spring, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Why Renters In Silver Spring Choose State Farm

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented property include a wide variety of things like your guitar, smartphone, tool set, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Michael Palmiotto has the experience and personal attention needed to help you evaluate your risks and help you keep your things safe.

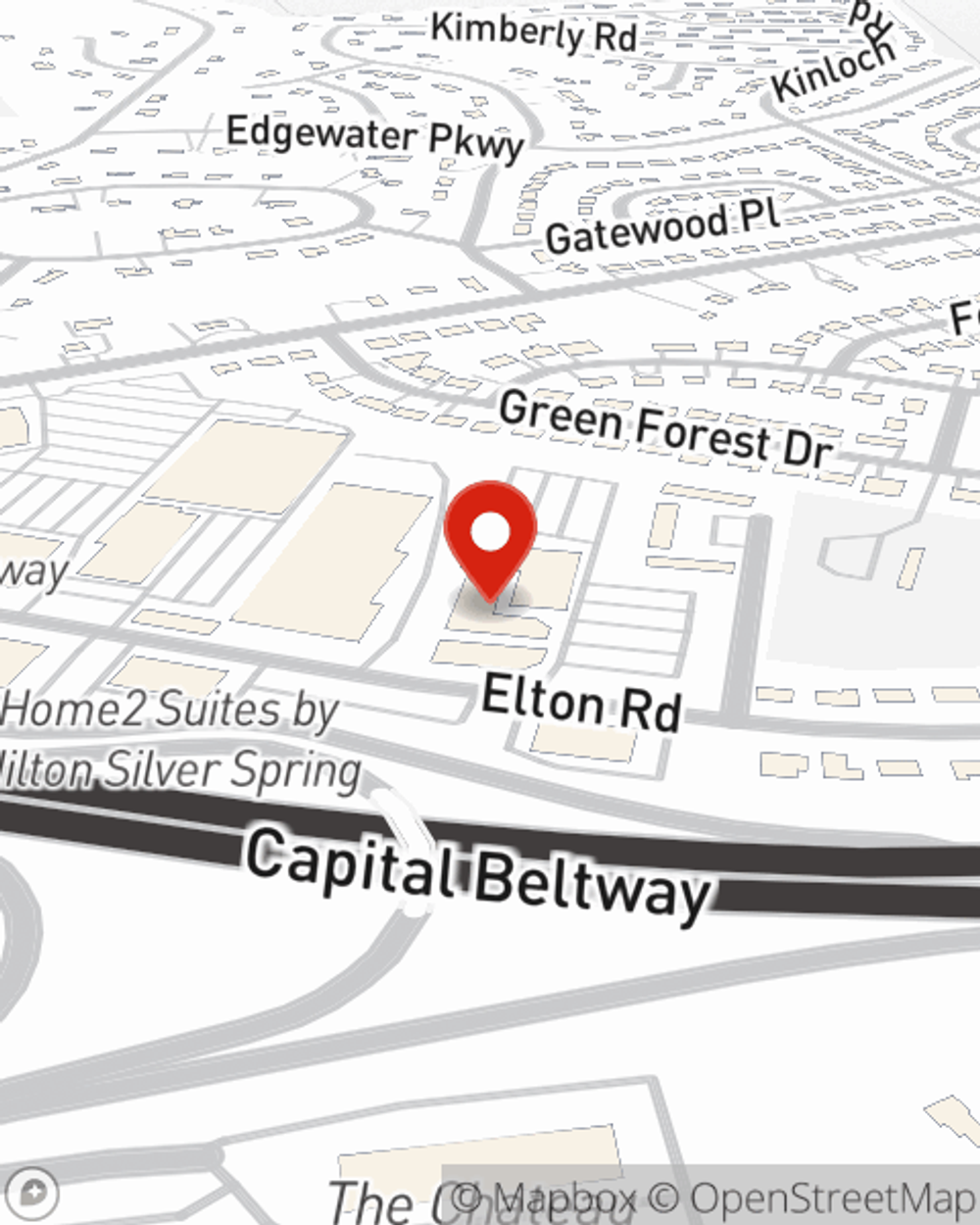

Renters of Silver Spring, call or email Michael Palmiotto's office to find out more about your individual options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Michael at (301) 431-2020 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Michael Palmiotto

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.